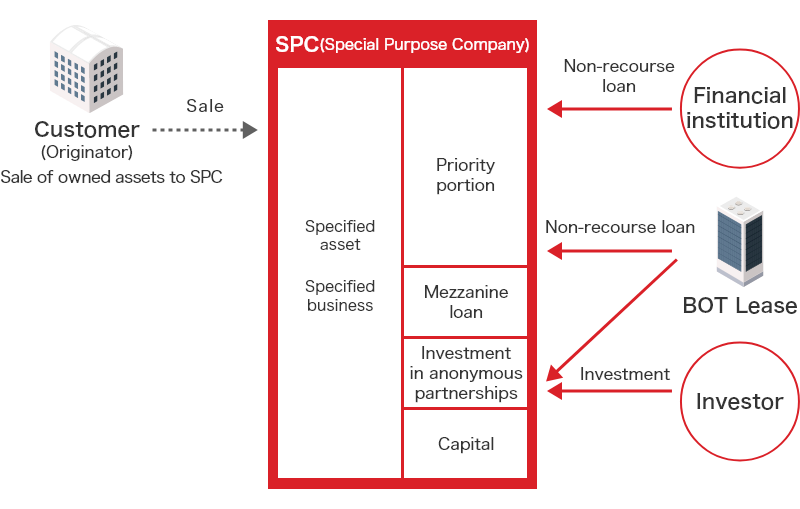

We provide financing using forms such as SPCs, beneficiary rights, and anonymous partnerships based on the cash flow generated by specific assets or specific businesses owned by the customer.

Scheme

Benefits

1. Diversification of financing

When starting a new business, it can be difficult to acquire financing due to reasons such as lack of creditworthiness or past performance. In such cases, by attributing specific assets or specific businesses that will generate future cash flow to an SPC, it is possible to acquire financing backed by that cash flow.

2. Improvement of financial indicators

When large-scale investment-related assets/liabilities are recorded on the customer's balance sheet, it leads to deterioration of financial indicators. By using a scheme such as an SPC, it is possible to separate from the customer's balance sheet and prevent deterioration of financial indicators.

Main target assets

Real estate (office buildings, logistics facilities, residences, etc.), energy-related facilities such as solar power generation projects, nursing care facilities