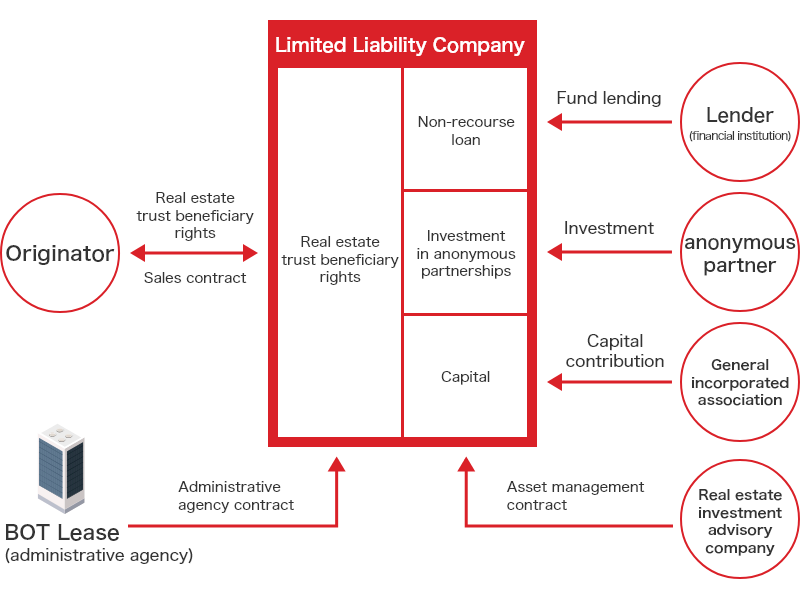

We provide SPC management services (administrative management services) for special purpose companies, limited liability companies, anonymous partnerships, Cayman entities, etc., established in asset securitization transactions to financial institutions and investment advisory firms.

Reasons why a leasing company performs SPC management operations

BOT Lease has a history of accumulating know-how in SPC management operations in international leasing operations through the use of SPCs in ship financing and aircraft financing. Based on this experience and track record, we started accepting SPC management operations for monetary claim securitization in the early 1990s, and subsequently developed our target operations to include SPC management operations for private real estate securitization funds.

Scheme

In the case of private real estate securitization funds

In the case of monetary claim securitization

Benefits

1. Administrative agency by specialized groups

We have established specialized groups for each securitized asset held by the SPC, such as monetary claims and real estate, and respond according to the needs of our customers (financial institutions, investment advisory firms, etc.).

2. Reliability and discipline as a bank-affiliated company

Under the disciplinary culture of a bank-affiliated company, we provide cash management services such as fund management and bank account management.

Main agency operations

We provide total services from the establishment of the SPC, through interim management, to dissolution and securitization procedures after the project ends.

1. Establishment and operation management of SPC

We provide the following services (major services shown) in cooperation with professionals such as lawyers and judicial scriveners:

- Preparation and signing of various contract documents

- Holding regular and extraordinary general meetings, preparing minutes, statutory advertisements

- Dispatch of representatives and other officers, provision of company location

- Registration necessary for company establishment, changes, dissolution, securitization

2. Fund management

Under the discipline and management policy of a bank-affiliated company, we provide the following services (major services shown):

- Fund settlement when purchasing assets subject to securitization

- Management of various payment due dates such as principal and interest payments on borrowings and payment of miscellaneous expenses

- Management of deposits and withdrawals from bank accounts, management of bankbook seals

- Preparation and reporting of cash distribution calculation sheets

3. Accounting processing, consolidated financial statement support

In cooperation with professionals such as accountants and tax accountants, we provide the following services (major services shown):

- Preparation of SPC financial statements and silent partnership financial statements

- Provision of information related to the preparation of sponsors' consolidated financial statements

- * Tax-related services are provided by our affiliated tax accounting firm.