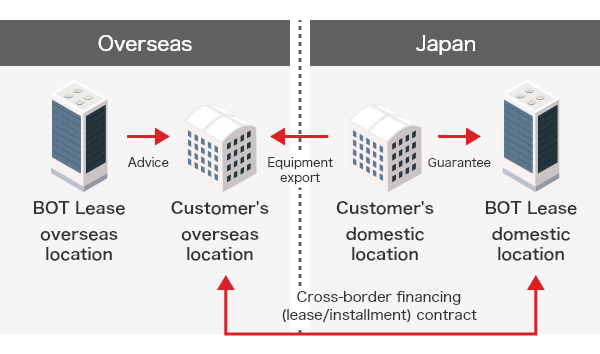

In the case of transactions between overseas and Japan

Transaction form between "Customer's overseas base" and "BOT Lease (Japan)"

Payment for equipment is completed within Japan, and the customer's overseas base repays based on that amount as principal. We review the customer's overseas base and, if necessary, request a debt guarantee from the customer (parent company).

In the case of domestic transactions within Japan

Transaction form between "Customer's domestic headquarters/branch" and "BOT Lease (headquarters/branch)"

By adding a clause regarding "consent for installing equipment overseas" in the domestic contract, customers can lend equipment that is the subject of domestic leasing or installment purchase in Japan to overseas locations. Also, as settlement is in Japanese yen domestically, administrative procedures such as foreign exchange reservations can be reduced.

Scheme

In the case of transactions between overseas and Japan

In the case of domestic transactions within Japan

Benefits

1. Diversification of financing

By having your overseas subsidiary directly financing, you can diversify your financing methods. Compared to conventional methods such as parent-subsidiary loans or capital investment, it's possible to streamline your balance sheet.

2. Reduction of foreign exchange risk

By structuring financing to match the local currency or revenue currency, foreign exchange risk can be reduced.

3. Reduction of interest rate rise risk

By adopting fixed interest rates, the risk of interest rate rises can be reduced.